The first look at comprehensive data on energy generation infrastructure added in the United States in 2013 shows a big jump in solar, a massive decline in wind, and natural gas dominant.

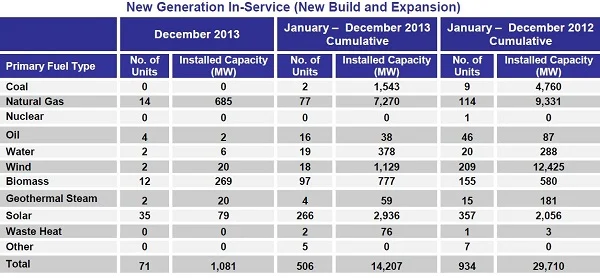

Overall, with demand fairly flat, just 14,207 megawatts of new capacity came online in 2013, according to the Federal Energy Regulatory Commission. That’s less than half the 29,710 MW added in the previous year.

image via Federal Energy Regulatory Commission

Solar contributed 2,936 MW of the 2013 total, up from 2,056 MW in 2012, and accounted for 21 percent of overall capacity additions. It’s always important to point out with solar that these totals represent utility-scale development and solar is unique in that it has a significant distributed side, on the rooftops of homes and businesses. Last month, the Solar Energy Industries Association said it expected total new solar in 2013 to come in around 4,268 MW.

Wind added 1,129 MW in 2013, less than a tenth of the 12,425 MW that went in the year before, when developers worked furiously to get projects completed in order to qualify for a key subsidy. The sector is expected to bounce back this year with 4,000-5,000 MW of new capacity. Its long-term future remains a bit cloudy, with the production tax credit again being debated, but the increasingly competitve cost of wind power could still bode well for its continued growth.

The amount of natural gas capacity added actually declined in 2013, from 9,331 MW to 7,270, but with the total for all energy types so much smaller, natural gas made up more than 51 percent of new generation capacity.

With such little new capacity coming online and some plants being shut down, the total installed capacity was almost unchanged in the past year (1,160.08 gigawatts in 2013 vs. 1,157.86 GW in 2012). Natural gas made up 42.8 percent of that overall capacity at the close of the year, up slightly from 42.0 percent a year earlier; wind rose slightly to 5.2 percent from 4.9; and solar nearly doubled its share, though it remained a small player at 0.64 percent of total capacity.

A note on this FERC data: It’s just one early look at the year’s generation picture, and later, sometimes more thorough analysis will be coming in over the next few months. So the data will shift, but the big picture shouldn’t.