It’s just one energy sector watcher weighing in, but Lux Research does have pretty good credentials, so we’ll run with it, leading with their headline: “Solar to Become Competitive with Natural Gas by 2025.”

So says the Boston-based consultancy in an eyebrow-raising analysis that adopts the view that, for now, cheap natural gas can be a better-than-coal alternative that will, indeed, get us to a point where solar can rock ‘n’ roll without subsidies.

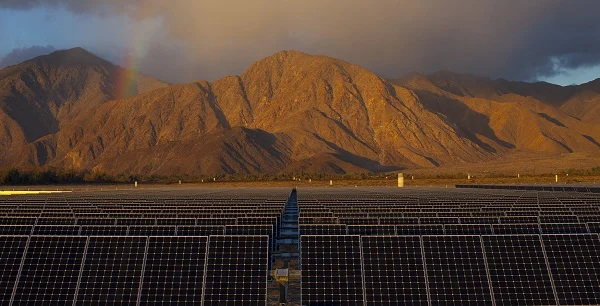

The Borrego 1 Solar Generating Station in California (image via NRG)

“On the macroeconomic level, a ‘golden age of gas’ can be a bridge to a renewable future as gas will replace coal until solar becomes cost competitive without subsidies,” Lux research associate Ed Cahill said in a statement. “On the microeconomic level, solar integrated with natural gas can lower costs and provide stable output.”

This used to be the view of many greens – as we’ve noted, it wasn’t long ago that 350 founder Bill McKibben, in his book Eaarth, was writing that “in the United States, we’ve found some new supplies of natural gas, which is a good ‘bridge fuel’ between dirty coal and clean sun.”

But as the price of natural gas has plunged and its use has grown, thanks to horizontal drilling and hydraulic fracturing techniques (fracking), issues of water contamination, methane release and microseismicity – and other problems – have turned environmentalists off on gas.

So far, the U.S. has largely been full speed ahead on gas, while elsewhere in the world that hasn’t been the case. How that dynamic plays out in the years ahead will influence when, exactly, solar reaches parity with gas – but Lux seems to think the day is inevitable.

“The levelized cost of energy (LCOE) from unsubsidized utility-scale solar closes the gap with combined cycle gas turbines (CCGT) to within $0.02/kWh worldwide in 2025. Solar’s competitiveness is led by a 39 percent fall in utility-scale system costs by 2030 and accompanied by barriers to shale gas production – anti-fracking policies in Europe and a high capital cost in South America.”

For big power plants, Lux sees thin-film solar systems dropping from a current price of around $1.96/watt installed to $1.20/W by 20130.