The government is trumpeting a new report that shows “wind energy production” reached record highs in 2012, which is weird because what they mean is wind energy capacity, and that’s old news.

Likewise the “news” that “wind energy became the number one source of new U.S. electricity generation capacity for the first time, representing 43 percent of all new electric additions: Had that months ago.

Still, the 2012 Wind Technologies Market Report is a treasure drove of the latest information on the progress of wind in the United States, and data on the cost front was certainly newsworthy and encouraging for the sector.

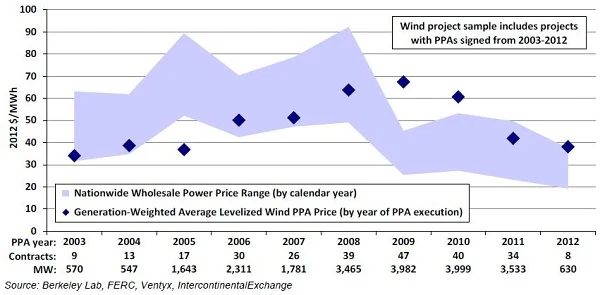

image from 2012 Wind Market Technologies Report

Turbine prices, at $700 per kilowatt back in 2002, had shot up to $1,500/kW by 2009, but now we’re seeing them in the $950–$1,300/kW range.

“These price reductions, coupled with improved turbine technology and more-favorable terms for turbine purchasers, are exerting downward pressure on total project costs and wind power prices,” the report said.

Indeed, “(a)mong a large sample of wind projects installed in 2012, the capacity-weighted average installed cost stood at nearly $1,940/kW, down almost $200/kW from the reported average cost in 2011 and down almost $300/kW from the reported average cost in both 2009 and 2010.”

And there was more good news on that front: “Anecdotal indications from a handful of projects currently under construction and anticipating completion in 2013 suggest that average installed costs may decline further.”

image via 2012 Wind Market Technologies Report

Similarly, “(a)fter topping out at nearly $70 per megawatt-hour in 2009, the average levelized long-term price from wind power purchase agreements signed in 2011/2012 – many of which were for projects built in 2012 – fell to around $40/MWh nationwide.

The picture on capacity factors – the measurement of a wind farm’s ability to turn installed capacity into actual electricity production – was a little blurrier. Overall, capacity factors were stagnant, but digging a little deeper the report found two trends offsetting each other: turbines were getting better, driving capacity factors higher, but more turbines are going up in poorer wind resource areas.

“Based on a sub-sample of wind power projects built from 2007 through 2011, average capacity factors in 2012 were the highest in the Interior region (36%) and the lowest in the Southeast (23%) and Northeast (24%) regions,” the report said. “Not surprisingly, these regional rankings are roughly consistent with the relative quality of the wind resource in each region.”

The full 2012 Wind Market Technologies Report is available online as an 81-page PDF.