We were delighted to have reported the fantastic growth of Q3 (21.4% over Q2, 7.3% year-to-year.) That clearly indicated the recession was over for graphics chips, and since they are a predictor of PCs, it forecasts a great holiday season for our desktop and portable companions. It’s also a bellwether of consumer confidence and the improvement in the economy in general – and take note – it’s the consumer, not IT, that’s leading the recovery.

But…

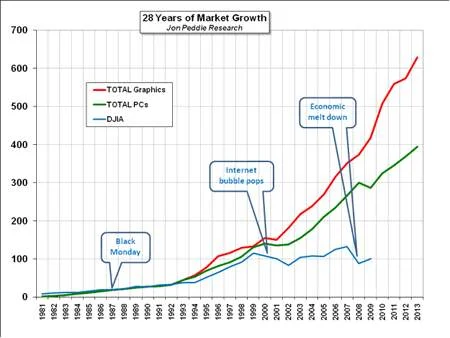

Don’t let it go to your head. Yes, we had a great V-shaped recovery (which I might point out JPR predicted) and the long term trend of the PC industry is back on track.

By the summer of 2010 we should be on a normal seasonal cycle again and everyone’s crystal ball will be a little clearer and comforting. But we’re not going into another bubble. We’re not going to see the insane run up of sales we saw in at the turn of the century or in Q3 of 2008. That’s not to say we won’t ever again have another crazy period of wild speculation and spending as if there was no tomorrow, we’re humans, we have short memories, and we’re greedy, yes, more bubbles are on their way, but not for a few years.

My prediction is we’ll have a modest growth in Q4. None of the OEMs or the companies in the channel are going to take any chances on letting inventory get bloated or out of control. There will be more pressure on JUT – just-in-time purchasing by the OEMs on their suppliers, and on down the chain. One of the best things to come out this last recession, especially given its rapid and scary freefall, was the inventory management the OEMs and channel executed. Sure a few companies got caught off guard, but for the most part the industry as a whole, and in particular the semiconductor suppliers (well, most of them), reacted quickly and made adjustments before there was major bloodletting. That’s a tribute to management information systems, and quick reaction management.

Credit is also due to the PC industry for the continuity of R&D investment, and new product development and design. This was true from chip design tools to end user consumer products and as a result, many, maybe even most of the companies in the industry did exactly what we predicted, and came out of the recession with a slew of new exciting and competitive products to stimulate the desire of the consumers. And these are consumers mind you whose main pent up desires revolved around melting their credit cards.

Control your enthusiasm.

As cynical as that may sound about gladly being willing to pay you Thursday for a hamburger today, it’s not. Credit spending seems like it’s still under control, and the consumer has changed (even if only temporarily.) “Buying up” is not the main call of the day although we think it will be factor in Q4. That sounds like double talk, so let me explain.

Consumers are value sensitive now; maybe we should say value smart. They will not, for a while (maybe a year or more) buy frivolously and plunge themselves into debt based on the expectations of wealth from some unknown magical source – like the imagined value of their house or stock options.

But they are also out of the refugee shock state and realize they have a job (those who do have jobs anyway), they have some discretionary income and they can buy a little better product than they might have thought or even planned six months ago. That will most dramatically be seen in laptops. Whereas the novelty and economics of a netbook made so much sense in Q4 2008 and Q1 2009, they are nonetheless crippled little machines with little displays and little performance. The one thing I’ve always said about the PC market (and graphics in particular) is it’s a really honest mercantile system in that you truly get what you pay for. For $300 to $400 you get a basic computer and for $1,000 you pretty much get three times more in a variety of parameters. This is a lesson the customer has learned after 28 years of buying these things.

So with the rise in consumer confidence those consumers, wizened by the experiences of the past year, will spend a bit more and “buy up” but cautiously and intelligently.

This is a good thing for the consumer, for the industry, and for the world’s economy in general. An intelligent consumer is the best thing we or any market can have. We’re not investing gazillions of dollars in fabs, and manufacturing, and human resources to sell snake oil – today’s PC is possibly the most sophisticated thing a consumer can buy. And when you pour your heart and soul into designing and building these things, you want a buyer who appreciates what you’ve done and doesn’t make a selection on the basis of the color of the case or the salesman’s smile.

So control your enthusiasm, be thankful we got through this recession, be even more thankful we all have learned a couple of hard lessons from it, and be particularly happy that we’re going to have good holiday season.

Epilog

Black Friday is coming – ignore it. It’s a holdover from the days of saddles and wax candles – it is not the ground hog day of consumer spending – it doesn’t measure on-line sales or impulse buying, and it is not a predictor of the future other than pundits scaring consumers and sellers with tea leave forecasts.