If you are under age 40 and saving to become financially independent, the ultimate strategy for you to understand is Lifecycle Investing. It has worked 100% of the time in the last 150 years and increased portfolios at retirement by an average of 63%.

Results are so consistent because it reduces one of your biggest financial risks, “Last Decade Risk”.

Lifecycle Investing is not for everyone, but understanding the concept can change your entire approach to managing your money.

To understand Lifecycle Investing, first you need to understand what is wrong with the traditional method of “bit-by-bit” saving.

When it comes to their investments, most people follow a pretty conventional formula called “bit by bit” saving, making an annual contribution to their RRSP or their TFSA and watching their contributions add up over the course of the years.

That would be all well and good and may work out fine. As long, that is, as you’re willing to bet against the “last decade risk” that’s inherent to this strategy and that can cause a big dent in your retirement income. The vast majority of the investments most people own during their working years are in the last 10-15 years before retirement.

For millennials, the time to avoid that risk is now. You can cut it way back by instead adopting what’s called a lifecycle investment strategy. As a millennial and being at the early stages of your lifecycle, you are in the best possible position to take control and diversify your investments over time.

Here’s what it all means.

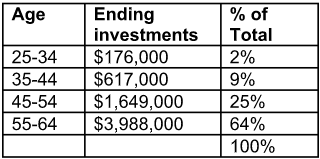

The typical path when you’re a “bit by bit” saver is to put, say, $10,000 each year in an RRSP, starting at age 25. As you, like most Canadians get more RRSP room, you increase that each year with inflation. The chart shows how your investments will grow each decade as you advance to age 64:

The problem with this approach is how such a large proportion of investments becomes so heavily weighted toward the later years – 82 percent after age 50. And that’s where the “last decade risk” comes in: What happens to your investments if the economy goes sour in the last decade before retirement?

Many Baby Boomers experienced that reality between 2000 and 2009, the second worst decade ever for the stock market, and have not been able to recoup the losses for the retirement they’d hoped for.

Millennials, however, can avoid that risk with lifecycle investing, which entails borrowing a large amount early and paying it off slowly over the years, so that each year you are investing the same amount. And if you think this sounds as dicey in its own way as the last decade risk, here’s how to shift your perspective: You’re “buying” your retirement nest egg in one large investment at age 25. Studies have shown that done right, over the long term, this ability to diversify across time can actually reduce your retirement risk.

Of course, you only borrow what you’re comfortable with and what you can qualify for in the early years. And there’s a formula for asset allocation with this strategy, divided between stocks and bonds, and based on the total you’ll invest during your lifetime, or “dollar years.” The idea is to borrow in your first decade of investing and allocating 100 percent to stocks. You pay off your debt over the years until your early 50s, which is when you start adding bonds to the mix.

The strategy is characterized by three periods in your working life:

1. High leverage period, for a 2:1 or more debt. If you have $10,000 to invest, borrow at least another $10,000 to invest each year. This covers about the first 10 years of your investing life, or until your stock investments reach the target percentage you’ve established for your lifetime investment amount.

2. Reduced leverage period. You’ll pay off the investment loan slowly, typically eliminating your debt by your early 50s. Your investments will be 100 percent stocks.

3. No leverage period. Now is the time to introduce bonds as you move to your desired allocation of assets until you retire.

If you want to implement Lifecycle Investing, it is best to create a Financial Plan first, to decide how to do it over your life. Don’t do it without a plan.

Most investors in their 30s and 40s believe that the most important part of their future retirement is the rate of return they get on their investments. This often leads them to ignore financial planning and just focus on investments. The concept here shows that having a plan and using the right strategy is far more important than rate of return.

A study of lifecycle investing by two Yale economists showed that this strategy would have increased retirement income 100 percent of the time for anyone retiring in the last 150 years.

Makes it worth looking into, don’t you think?

Ed Rempel is a financial blogger and CFP Professional. You can learn more about him by visiting his Twitter and Facebook pages.