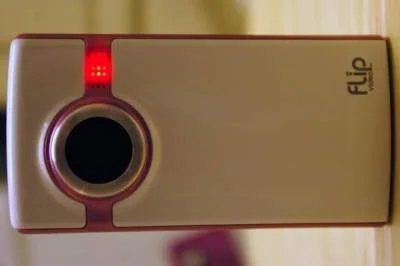

Cisco is “exiting aspects” of its consumer business in an ostensible effort to realign company priorities. The primary casualty of this initiative? Cisco’s Flip.

“We are making key, targeted moves as we align operations in support of our network-centric platform strategy,” John Chambers confirmed in an official press statement.

“As we move forward, our consumer efforts will focus on how we help our enterprise and service provider customers optimize and expand their offerings for consumers, and help ensure the network’s ability to deliver on those offerings.”

However, as Therese Poletti of MarketWatch notes, Cisco’s decision to shutter its Flip business was greeted with only “tepid” approval on Wall Street, with investors expecting the corporation to make additional moves to bolster paltry growth.

“The Flip business is a small, single-digit contribution to Cisco’s total revenue,” explained Poletti.

“Another consumer business that has seemingly given the company more grief is Scientific-Atlanta, for which Cisco paid $5.1 billion, net of the cable set-top box maker’s cash balance, in 2005.”

Meanwhile, Citigroup analyst John Slack opined that Cisco must decide whether or not to shield its profit margins at the expense of market share, or join the price cutting club.

“Cisco needs to choose between protecting share or preserving margins,” Slack said in a note to clients on Tuesday.

“It simply can’t do both and that management needs to be frank with the investing community and significantly reset its operating model to the ‘new normal.'”