In my community there is an actual ongoing debate whether Elon Musk has a substance abuse problem because the guy has been drifting a tad too much toward the wrong side of crazy. Flame Throwers, Surf Boards (both of which sold out) seemed a bit over the top given none of his companies are profitable and Tesla’s cash burn rate was well past the level that would concern most of us. Given California goes up in flames on a regular basis the Flame Thrower in particular looked at least tone-deaf particularly given California is Tesla’s biggest success story of late. (To be fair neither of these backfired on the guy but both were unneeded distractions at a time when Tesla, and Musk, need to be focused like a laser on profitability.

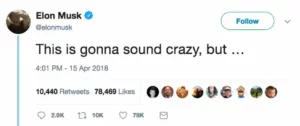

But over the last few days he has talked about replacing his NVIDIA based self-driving technology with his own home-grown solution and taking Tesla private. Unless he has a money tree that hasn’t been disclosed with path will be nearly impossible to execute.

Let me explain.

Do It Yourself Autonomous

Musk rightly pointed to NVIDIA’s past technology, which he uses in his Tesla cars, as inadequate for the next generation. Full autonomous driving needs far more compute power and a 10x requirement, at least, is needed. What is screwy is NVIDIA agrees and so they did a ground up redesign of their platform and announced Xavier which is 10x faster. Or in line with what Tesla is developing so Tesla is already behind. And, if you wanted a Tesla that did self-drive, wouldn’t you want to wait until this hardware was in place to buy it? There is a term for this, Osborn (and look what happened to that company).

Now it is estimated to get to Xavier took NVIDIA 5 years and about $2B in R&D investment. This space isn’t cheap, and these resources were used to develop both the platform and the eco-system around it. Part of that eco system is virtualized training and machine learning so the system doesn’t have to initially learn on a real road (putting drivers and pedestrians in danger).

There are also several foundational elements, value unknown, that allowed NVIDIA to enter this market in the first place. Tesla expects to have cars using this on the road next year which means they’ll need to take several shortcuts and massively speed up development. This means they didn’t accurately scope the project, will either miss their deadline or have a solution that isn’t fully developed or adequately trained, or they plan to use someone else’s technology to get their quickly.

This last is the approach Uber tried to use and it ended badly. But now lets look at Tesla’s resources, they have about $6.7B in assets and $9.1B in existing liabilities which means, right now, the banks not the investors own Tesla. If Tesla went under the banks wouldn’t even get their money and their $2B in cash would just barely cover the cost of recreating, legally, what NVIDIA already has.

Every reserve they have should be focused on getting cars out the factory door in enough volume to get the company into the black. Once in the black exploring ideas like this might make sense or even if the switch was both immediate and free but it is neither.

Going Private

Now that sounds interesting until you think of the mechanics. To go private, he’ll have to buy back all the shares and likely convert the existing debt. Given his debt massively exceeds his assets the stock value, based on equity, is negative. So, he’ll have to convince either a bank or some private equity firms to buy, at $420 a share, all of Tesla’s stock, and then hold a position second to the banks who currently carry loans in excess of the assets supporting them.

So, once again, I’m wondering where the money is coming from. Given banks are already nearly $3B over assets it is hard to believe a bank will come up with the billions to buy out the shareholders but at least they’d get a favored position if Tesla went under. But private equity would be totally screwed with no chance of recovery should Tesla be unable to find a path to profitability.

Taking Dell private was a total PTA even though the firm was profitable at the time and had a far more reasonable debt to equity ratio. Granted, given the inflated valuation that Tesla enjoys, it is less likely that an “activist” investor would attempt to screw up the deal asking for more money. If they got $420 a share they’d likely run screaming naked in the streets (a good reason not to visit Wall Street if this happens).

Now one way to do this would be to basically go bankrupt, collapse the stock, and then work with the banks to allow the firm to reemerge as a private company. But given the massive number of stockholders that would be left with nothing I have to believe that the SEC and the clear majority of investors would react really badly to this kind of plan.

Wrapping Up: Is Musk Running With Scissors?

Now on moving from NVIDIA, typically you’d announce about the time you were ready to actually move, not years in advance because, should the technology fail or run late, it is better this happen behind the scenes not in public. On going private typically your assets must exceed your liabilities so that lenders or private investors will find the property attractive. But how much would you pay for a business that is operating deeply in the red and has more liabilities than assets? I’m thinking the seller would have to pay the difference for me to even consider taking it.

And this all doesn’t even take into account the massive number of Tesla competitors coming from Porsche, Mercedes, and Jaguar starting this year (though barely). They should be focusing almost exclusively on strategies that get Tesla into the black, once profitable, then playing around with “not invented here” strategies and even going private might make sense. Now, they’ll likely just burn cash more quickly and at the current cash burn rate, they’ll have issues making it through 2019.

I’m starting to wonder whether Musk has a death wish because, while he did spike the stock today, he should be far more focused on getting Tesla profitable than all this other crap. Just saying.